Service hotline

+86 0755-83044319

release time:2024-09-04Author source:SlkorBrowse:6308

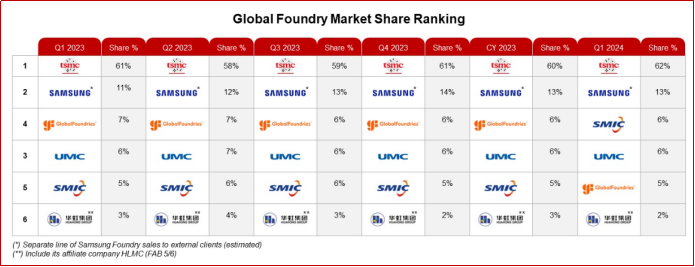

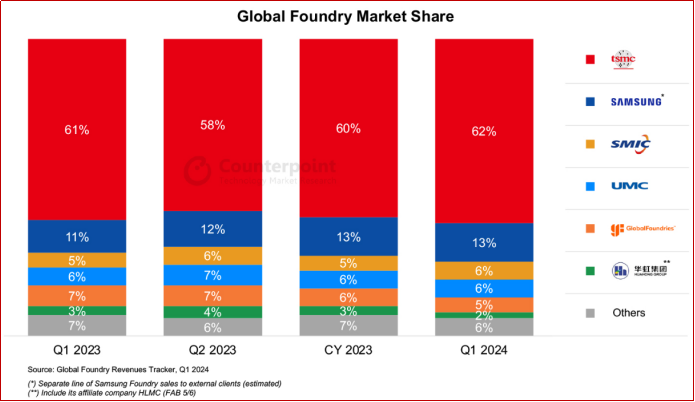

According to a report by research firm Counterpoint published on May 22, 2024, SMIC has surged to become the third largest wafer foundry globally in Q1 2024, trailing only TSMC and Samsung, with a market share of 6%.

The report states that global wafer foundry revenue in Q1 2024 decreased by approximately 5% quarter-over-quarter but increased by 12% year-over-year. The quarter-over-quarter decline in industry revenue was not only due to seasonal effects but also impacted by a slow recovery in demand for non-AI semiconductors, including those for smartphones, consumer electronics, IoT, automotive, and industrial applications.

TSMC's Q1 performance slightly exceeded market expectations, with a market share of 62%. The company raised its revenue forecast for data center AI, expecting it to more than double year-over-year in 2024. Additionally, TSMC extended its AI revenue CAGR guidance of 50% through 2028, indicating continued strong demand for AI. Despite a projected more than doubling of CoWoS capacity by the end of 2024, it still won’t meet the strong AI demand from customers. Notably, TSMC's 5nm capacity utilization remains strong due to robust demand for AI accelerators.

Samsung's foundry revenue decline was mainly due to seasonal factors in smartphones, maintaining the second position with a 13% market share in Q1 2024. The company anticipates a rebound in revenue with double-digit growth as demand improves in Q2 2024.

SMIC's Q1 2024 results surpassed market expectations, with a wafer foundry revenue market share of 6%, marking its first time at third place. The company anticipates continued growth in Q2 2024 as inventory replenishment broadens.

UMC and GlobalFoundries both noted that consumer and smartphone demand has bottomed out. However, automotive demand remains mixed, with UMC expecting a short-term slowdown and GlobalFoundries forecasting a revenue increase in Q2 2024.

After several quarters of inventory destocking, a demand recovery is beginning to emerge. Channel inventories are normalizing and streamlining. The report highlights that strong AI demand and moderate end-demand recovery will drive industry growth in 2024.

SMIC's Q1 2024 revenue reached $1.75 billion, up 19.7% year-over-year and 4.3% quarter-over-quarter. This marks SMIC's first quarter surpassing UMC and GlobalFoundries, temporarily making it the second-largest pure-play foundry globally, behind TSMC.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd