On February 17th, according to the latest report from market research firm Counterpoint, the global semiconductor market (including memory chips) experienced a strong recovery in 2024, with annual revenue increasing by 19% year-on-year to reach $621 billion (approximately 4.50 trillion RMB).

This remarkable growth was primarily driven by the rising demand for artificial intelligence technologies, particularly the sustained momentum in the memory market and GPU demand.

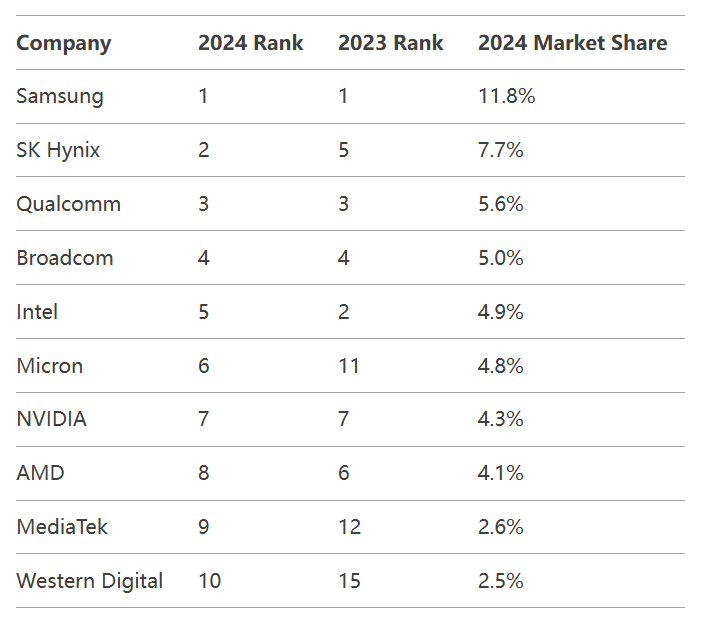

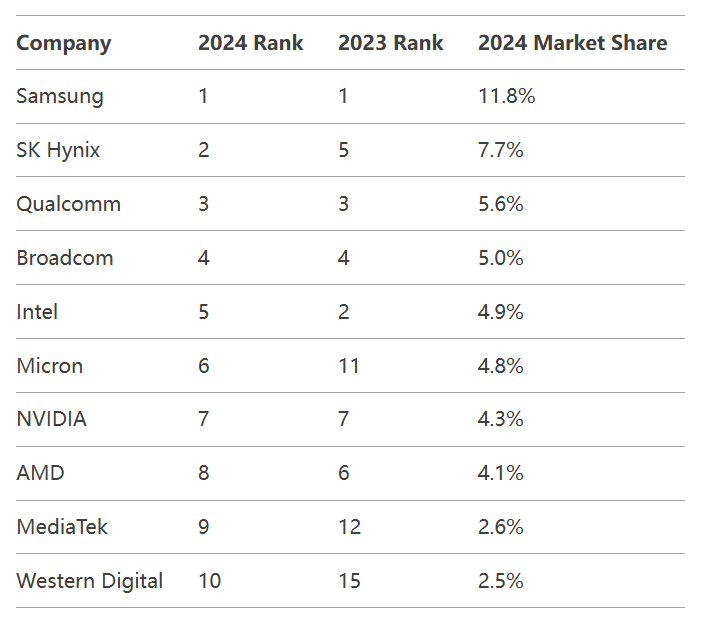

Below is the latest ranking:

Note: This ranking only includes semiconductor companies with their own brands. Foundries like TSMC are not included.

Samsung Electronics, with an 11.8% market share, firmly holds the top position among the world's top ten semiconductor brand manufacturers.

This is primarily due to the dual growth in demand and prices for memory chips, the rational adjustment and replenishment of smartphone business inventory, and the successful attraction of AI/HPC customers to adopt advanced processes. Despite challenges such as HBM3e delays and low-end memory issues, Samsung's leading position remains solid.

SK Hynix follows closely with a 7.7% market share. Micron holds 4.8%, with both companies benefiting from the booming memory chip market and the strong demand for HBM driven by AI applications.

Qualcomm ranks third with a 5.6% market share, achieving a 14% year-on-year sales growth. The recovery of the Android smartphone market and the growth of its automotive business have provided strong momentum, although the recovery of the IoT market has been relatively slow.

The once-dominant Intel has dropped to fifth place, with a market share of only 4.9%. Weak demand in the PC and server markets, coupled with operational difficulties, has significantly increased its competitive pressure.

From an overall market perspective, the memory chip market has become a major highlight of growth, with revenue expected to surge by 64% year-on-year. As the demand for memory chips rebounds in 2024, prices are also rising. Additionally, the rapid growth of the HBM market driven by AI is further supporting the prosperity of the memory chip market.

In the logic semiconductor market, due to the critical role of GPUs in AI model training and development, a year-on-year growth of 11% is expected. Although demand in the automotive and industrial markets has been weak, there is still some signs of recovery, contributing to the revenue growth of the global semiconductor industry.

Where is the semiconductor market heading in 2025?

AI chips are becoming the core battlefield: AI computing demand is driving the need for GPUs and HBM, and in the coming years, memory chips, data centers, and edge computing will continue to experience high growth. The battle for AI chips between Nvidia, AMD, and Intel is intensifying!

Memory market recovery, with HBM becoming the key breakthrough: Samsung, SK Hynix, and Micron are accelerating the expansion of HBM production capacity to meet the AI computing power demand. The HBM market is expected to see a growth rate of over 100% by 2025, making competition between suppliers even fiercer!

The PC and server markets remain sluggish, and how Intel will turn around is still uncertain: Whether Intel can stage a comeback through AI PCs and foundry services (IFS) remains to be seen. The rise of AMD and Arm architecture is continuously eroding Intel's market share!