Service hotline

+86 0755-83044319

release time:2024-08-28Author source:SlkorBrowse:16195

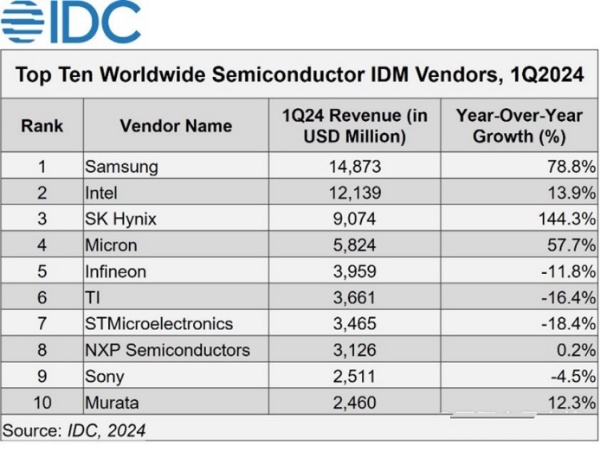

According to the latest rankings from International Data Corporation (IDC), three of the top five global IDM (Integrated Device Manufacturer) suppliers in Q1 2024 are memory-related companies, accounting for nearly half of the revenue among the top ten suppliers. During this period, the demand from data centers for AI training and inference surged, particularly increasing the demand for HBM memory. Meanwhile, the high prices of HBM and the reduction in general DRAM capacity have also contributed to a rise in the average DRAM prices, resulting in substantial revenue growth in the overall memory market.

According to IDC, HBM prices are four to five times higher than traditional memory. The growing demand has squeezed DRAM capacity in the market, driving up prices and significantly boosting overall memory market revenue. Additionally, new AI PCs and AI smartphones require more memory than traditional devices, further driving market growth.

The top ten suppliers are Samsung, Intel, SK Hynix, Micron, Infineon, Texas Instruments, STMicroelectronics, NXP, Sony, and Murata.

Specifically, Samsung leads with $14.87 billion in revenue, a 78.8% increase year-over-year. Intel follows with $12.14 billion in revenue, a 13.9% increase. SK Hynix ranks third with $9.07 billion in revenue, marking a 144.3% increase. Micron is fourth with $5.82 billion in revenue, a 57.7% increase. Infineon is fifth with $3.96 billion, Texas Instruments is sixth with $3.66 billion, STMicroelectronics is seventh with $3.47 billion, NXP is eighth with $3.13 billion, Sony is ninth with $2.51 billion, and Murata is tenth with $2.46 billion.

Due to the rebound in memory prices and increased market demand, the three major memory manufacturers—Samsung, SK Hynix, and Micron—each achieved over 50% revenue growth year-over-year in the first quarter of 2024. As demand for AI in data centers and devices continues to grow, memory is expected to remain a key driver for IDM development in the latter half of 2024.

In the first quarter of 2024, computing remains the primary application for IDMs, accounting for 35% of the total share, up from 29% the previous year. The wireless communication market follows closely.

Under the pressure of increasing chip inventories, the automotive market is showing signs of weakness, while the industrial market is focusing on inventory reduction. Last year’s supply chain disruptions led some customers to over-order and stockpile goods to mitigate supply chain risks. As a result, the market share for both automotive and industrial sectors has significantly decreased compared to the same period last year. IDC expects these markets to prioritize inventory adjustments in the first half of 2024 and to experience a rebound in the third quarter.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd