Service hotline

+86 0755-83044319

release time:2024-09-04Author source:SlkorBrowse:7515

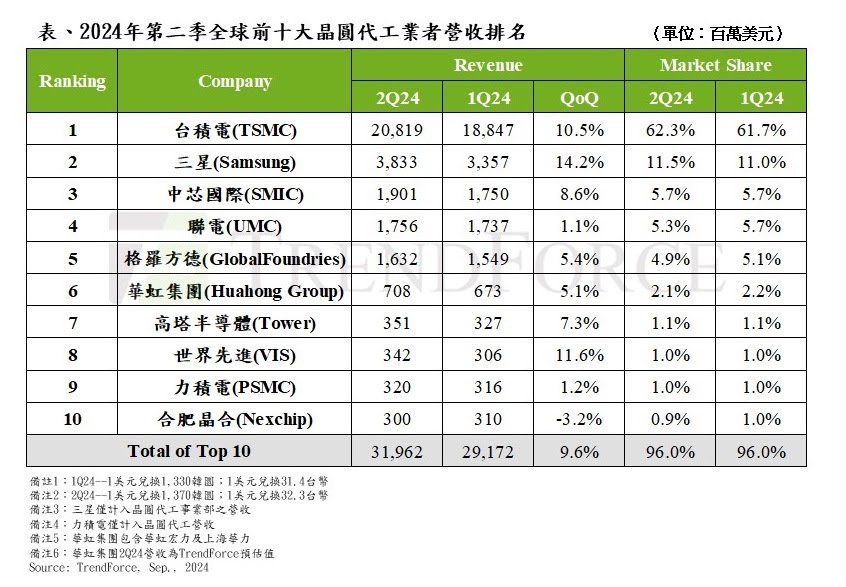

In terms of rankings, the top five foundries in Q2 2024 remained the same as in Q1, listed as TSMC, Samsung, SMIC, UMC, and GlobalFoundries. The sixth to tenth places were occupied by Hua Hong, Tower Semiconductor, World Advanced, VIS, and JCET. World Advanced moved up to eighth due to increased DDI orders and benefits from de-Chinaization policies, while VIS and JCET dropped to ninth and tenth, respectively.

The recent performance of major semiconductor foundries highlights a positive trend driven by strong demand across various sectors:

TSMC: In the second quarter, TSMC experienced a 3.1% increase in wafer shipments from the previous quarter. Revenue grew by 10.5% to $20.82 billion, largely due to the high contribution from advanced process technologies. TSMC maintained a dominant market share of 62.3%.

Samsung: Benefiting from Apple's iPhone production, Samsung's revenue rose by 14.2% to $3.83 billion in Q2. This was driven by the demand for peripheral chips such as Qualcomm's 5/4 nm 5G chips and OLED DDIs. Samsung's market share was stable at 11.5%.

SMIC: Driven by urgent orders related to the 618 shopping festival in China, SMIC saw a 17.7% increase in wafer shipments and an 8.6% rise in revenue to $1.9 billion. SMIC's market share reached 5.7%, maintaining its position as the third-largest foundry.

UMC: UMC also benefited from mid-year consumer demand, particularly for TV-related ICs and low-end MCUs. Wafer shipments increased slightly by 2.6%, and revenue grew by 1.1% to $1.76 billion. UMC's market share stood at 5.3%, ranking fourth.

GlobalFoundries: Despite a decline in average selling prices (ASP), GlobalFoundries saw a 5.4% increase in revenue to $1.63 billion. Its market share is 4.9%, placing it fifth.

Huali: Huali experienced a 5.1% increase in revenue to $710 million, driven by mid-year promotional activities and urgent orders. The company's market share is 2.1%, making it the sixth-largest foundry.

Tower Semiconductor: With improved wafer shipments and a favorable product mix, Tower Semiconductor's revenue grew by 7.3% to $350 million. Its market share is 1.1%, ranking seventh.

World Advanced: Benefiting from China's 618 shopping season and increased customer demand for power management ICs, World Advanced's revenue grew by 11.6% to $340 million. The company's market share is approximately 1%, ranking eighth and surpassing both Powerchip and JCET.

Powerchip: Despite a rebound in memory chip production, Powerchip's revenue increased slightly by 1.2% to $320 million. Its market share remains at 1%, placing it ninth.

HC SemiTek: HC SemiTek's revenue was $300 million, a slight decrease of about 3.2% from the previous quarter, with a market share of 0.9%, ranking tenth.

TrendForce Analysis:

As we move into the third quarter, traditionally a peak season for inventory stocking, the semiconductor market outlook remains positive. Despite global economic uncertainties impacting consumer confidence, new releases in smartphones, PCs, and notebooks are expected to drive continued demand for SoCs and peripheral ICs. Additionally, strong growth in AI servers and HPC will likely sustain high demand through the end of the year, with some advanced process orders extending into 2025. TrendForce predicts that the top ten global foundries will see further revenue growth in Q3, with quarterly increases expected to be on par with Q2.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd