The drive system is mainly used in inverter DC-AC, which converts the 12V direct current of rechargeable battery into 220V alternating current to drive the motor to work. Dozens of igbts are needed in the motor control system. After the high voltage is output from the battery, it needs to be changed from DC-DC to low voltage and then used in the low-voltage network of the automobile. For example, Tesla's three-phase AC asynchronous motor uses 28 igbts in each phase, and other motors have 12 igbts. Tesla uses a total of 96 igbts.

The electronic control system is the second largest single component in the value of electric vehicles. The purchase cost of electronic control in a single electric vehicle is about 3000-5000 yuan, of which IGBT accounts for 41% of the electronic control cost. It is the core component of electronic control, and its function is mainly to change the current on the vehicle charger. In addition, IGBT is also used in low-power inverter parts such as air conditioning system and PCT heater.

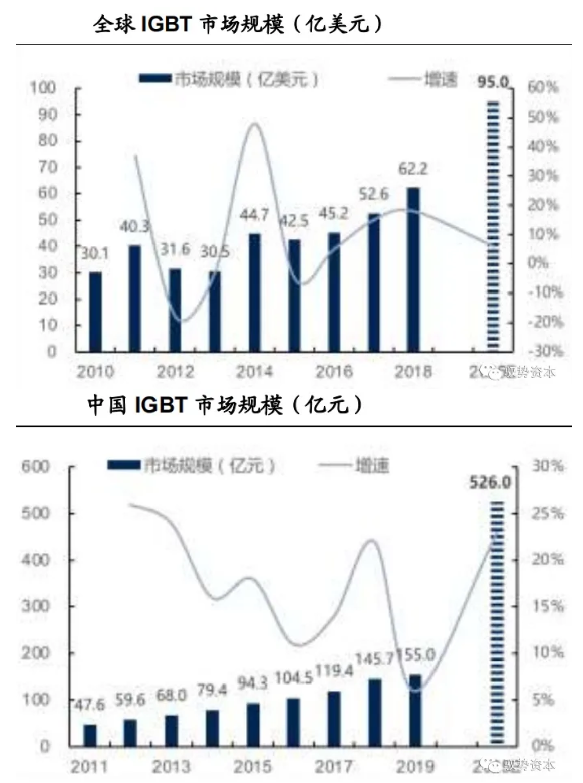

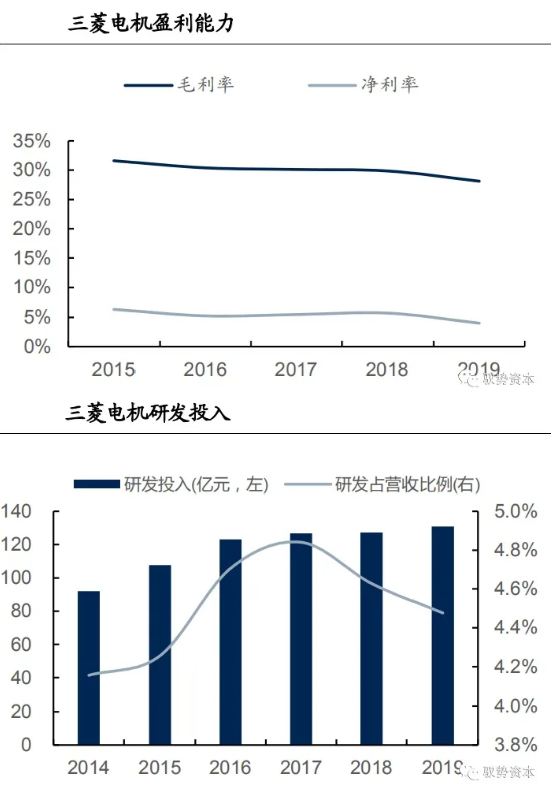

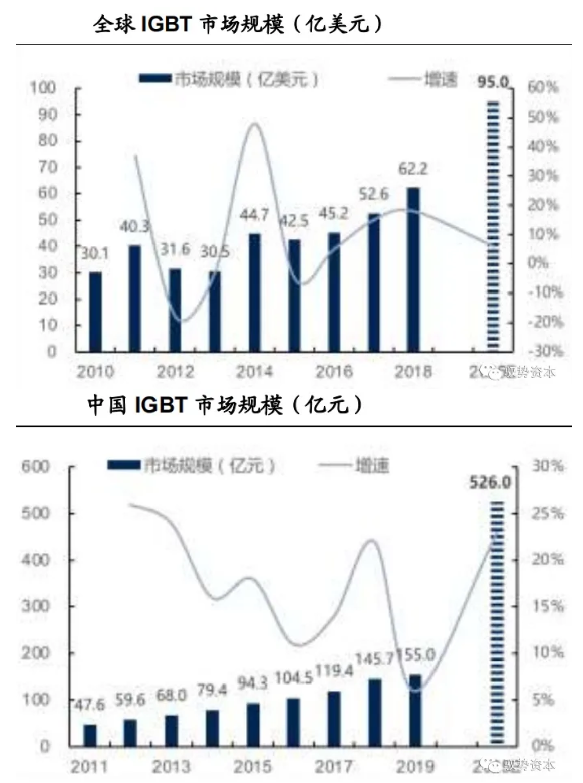

The market size of IGBT is large. The global IGBT market is about USD 6.224 billion in 2018, and it is expected to reach USD 9.5 billion in 2025. China's IGBT market will reach 15.5 billion yuan in 2019. According to Trendforce's forecast, China's IGBT market will continue to grow thanks to the substantial increase in the demand of new energy vehicles and industries. It is estimated that China's IGBT market will reach 52.6 billion yuan (US$ 7.5 billion) by 2025, with a compound annual growth rate of 19.11%.

Competitive pattern. At present, IGBT chips are basically monopolized by foreign capital, and China's IGBT is highly dependent on imports. According to Infineon's statistics on the global market structure in 2018, as the only domestic company, Modular Star Semiconductor ranks among the top ten, accounting for 2.2% of the market. From the perspective of automobile power semiconductor companies, the top five enterprises are mainly foreign-funded enterprises such as Infineon and STM, with a market share of 63%, and the overall market is still monopolized by overseas.

In addition to Starr Semiconductor, CRRC Times Electric and BYD are domestic independent research and development leaders of IGBT. According to the statistics of domestic IGBT market in 2019, the market share of three Chinese companies (BYD, Starr Semiconductor and CRRC Times Electric) among the top 10 suppliers is only 20.4%, with a low degree of localization. Compared with the global market, the domestic market ecology is relatively loose, and domestic brands gain a relatively higher market share.

On the whole, there is a large market space for IGBT, and at present, the localization degree is low, and there is a large replacement space for the localization of car gauge IGBT. At present, domestic leading enterprises have entered the head market, and their technology has developed rapidly. With the strong support of policies and capital, domestic manufacturers are expected to open up the market gap and occupy some market shares.

Track 2: The third generation semiconductor SiC and other devices are emerging.

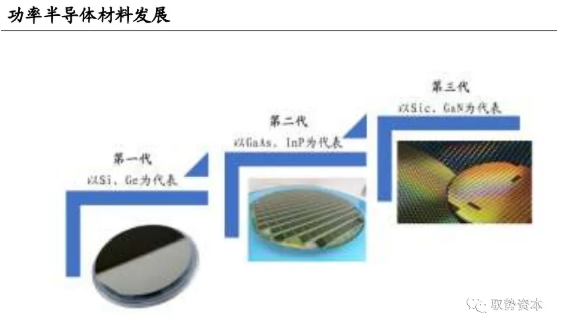

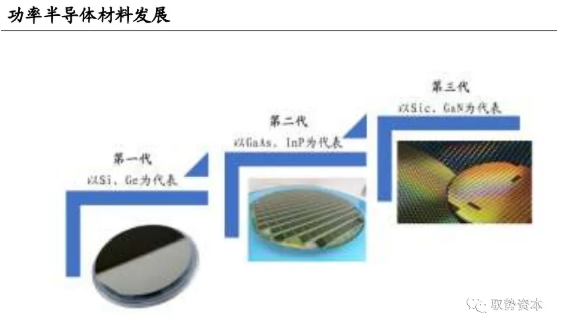

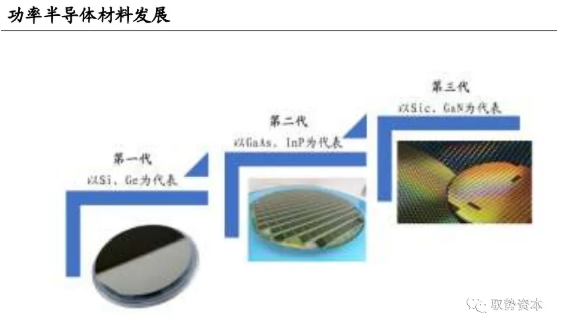

It is the first generation basic material in the semiconductor industry. At present, more than 95% of the integrated circuit components in the world are made of silicon. After decades of development, semiconductor materials can be divided into three generations:

The first generation of semiconductor materials: single crystal semiconductor materials such as germanium and silicon. Silicon has a bandgap of 1.1eV and is very stable after oxidation.

Second-generation semiconductor materials: compound semiconductor materials such as gallium arsenide and indium antimonide. Gallium arsenide has a bandgap of 1.4 electron volts and an electron mobility five times higher than that of silicon.

The third generation semiconductor materials: wide bandgap semiconductor materials represented by silicon carbide and gallium nitride, which have outstanding advantages such as higher saturation drift speed and higher critical breakdown voltage, are suitable for high power, high temperature, high frequency and anti-irradiation applications.

Since the development of semiconductor materials, the first generation of silicon semiconductor has been close to perfect crystal. The design and development of devices based on silicon materials have been optimized and updated by many generations in structure and technology, and are gradually approaching the limit of silicon materials. The potential of improving the performance of devices based on silicon materials is getting smaller and smaller. The third-generation semiconductors, represented by GaN and SiC, have excellent physical properties of materials, which provide more space for further improving the performance of power electronic devices.

The third generation semiconductor, also known as wide bandgap semiconductor because of its physical structure, is mainly represented by gallium nitride and silicon carbide. Its performance characteristics are different from those of the first generation silicon and the second generation gallium arsenide, which makes it have the advantages of high bandgap, high thermal conductivity, high breakdown field strength, high electron saturation drift rate, etc., so that it can develop miniaturized power semiconductor devices that are more suitable for harsh conditions such as high temperature, high power, high voltage, high frequency and radiation resistance.

Compared with Si, SiC has the advantages of high pressure resistance, high temperature resistance and high frequency, which is a revolutionary breakthrough in the material side. In terms of high voltage resistance, the breakdown field strength of SiC is 10 times that of Si, which means that the epitaxial layer thickness of SiC MOSFET wafers with the same voltage level only needs one tenth of that of Si, and the corresponding drift region impedance is greatly reduced. Moreover, the SiC band gap width is 3 times that of Si, so the conductivity is stronger. In terms of high temperature resistance, the thermal conductivity and melting point of SiC are very high, which is 2-3 times that of Si. In terms of high frequency, the electronic saturation speed of SiC is 2-3 times that of Si, and it can achieve 10 times of operating frequency.

According to Rohm's forecast of SiC MOSFET's progress in automobile application, with the maturity of technology, SiC MOSFET will gradually replace some si MOSFETs. The inverter made of all SiC power modules can reduce the switching loss by 75% (the chip temperature is 150°C), reduce the size of the inverter by 43%, lighten the weight by 6kg, and finally increase the continuous cruising range of the automobile by 20-30%.

At present, the penetration rate of SiC market is relatively low. According to Cree's prediction of SiC devices, the global sales of SiC devices in 18 years will be 420 million USD, and it is expected to reach 5 billion USD in 2024. After Tesla used SiC for Model 3 in 2018, more than 90% of electric vehicle factories decided to use SiC, and the entire electric vehicle industry chain was out of stock.

Seen from the competitive situation, Cree, Rohm and ST have all formed a vertical supply system of SiC substrate-epitaxy-device-module, while Infineon, Bosch, On Semi and other manufacturers buy SiC substrate, and then epitaxially grow and manufacture devices and modules by themselves.

At present, the supply of SiC market is firmly controlled by substrate manufacturers, with Cree, II-VI and Si-Crystal (owned by Rohm) accounting for 90% of the total shipments, while Cree, Rohm, Infineon and ST, the suppliers of devices and modules, account for more than 70% of the market share. However, as a whole, the market is still in the initial stage, the penetration rate is low, and the competition pattern in the next few years is still uncertain.

At present, there are many players in SiC in China, and many companies have entered the track on the material side, such as Tianke Heda and Shandong Tianyue; In terms of extension, there are Hantian Tiancheng, Dongguan Tianyu, Sanan Integration, CLP and so on. Ann is the leading enterprise with the most comprehensive layout of the third generation semiconductor at present, and many downstream vehicle manufacturers and power device manufacturers have joined the circuit.

On the whole, the market penetration rate of SiC power devices is low, and the growth rate is fast. At present, the enterprises in the industry are still in the stage of staking a horse, and the market competition pattern is uncertain. Domestic manufacturers are expected to gain a certain share in the future incremental market.

Representative enterprises of power semiconductors at home and abroad

Major domestic power semiconductor companies

Due to the high threshold of the automotive semiconductor market, there are strict requirements in many aspects, such as operating environment, device stability, reliability and failure rate. In addition, the life cycle of automotive semiconductor products usually requires more than 15 years (that is, the whole vehicle life cycle can work normally), and the supply cycle may be as long as 30 years. Therefore, in the automotive semiconductor industry, IDM mode is the main development mode of manufacturers. Representative domestic listed companies include Starr Semiconductor, BYD Semiconductor, CRRC Times Electric, Sanan Optoelectronics, etc.

BYD Semiconductor Company, a subsidiary of BYD, is the largest IGBT manufacturer in China. The company's main business covers R&D, production and sales of power semiconductors, intelligent control IC, intelligent sensors and photoelectric semiconductors. With IDM mode, it has an integrated whole industrial chain including chip design, wafer manufacturing, package testing and downstream applications. According to the news of science and technology innovation board Daily, at present, BYD has five generations of IGBT and three generations of silicon carbide MOSFET, and its own SiC production line is under construction. BYD's flagship model, Han EV 4WD, is the first model equipped with SiC MOSFET components in batches in China. According to the plan announced by BYD, it is expected that by 2023, its electric vehicles will fully replace SiC power semiconductors, and the performance of the whole vehicle will be improved by 10% on the existing basis.

Since its establishment, Starr Semiconductor has been engaged in the design, development and production of IGBT-based power semiconductor chips and modules, and sold them to the outside world in the form of IGBT modules. According to the data of IHS Markit, in 2018, the company ranked eighth in the global IGBT module market and first among domestic enterprises. At present, we have independently designed and mass-produced the sixth generation IGBT chip (FS-Trench), and mastered the phase.

The packaging technology has broken the monopoly of foreign power semiconductor giants in realizing IGBT chips for a long time. In addition to IGBT, the company's products also include MOSFET modules, thyristors, SiC power devices, etc. A few days ago, the company announced an investment of about 229 million yuan to build an all-silicon carbide power module industrialization project. It is estimated that the construction period of the project will be 2 years. After completion, the project will have an annual production line of 80,000 all-silicon carbide power modules and a research and development test center.

In 2019, the company's revenue reached 779 million yuan, a year-on-year increase of 15.41%, and its net profit reached 136 million yuan, a year-on-year increase of 40.74%. In the past five years, the compound growth rate of the company's revenue and net profit has reached 32.6% and 62.81% respectively. In 2019, the sales revenue of IGBT modules accounted for 97% of the operating income, among which the sales revenue of 1200V IGBT modules accounted for 73% of the operating income, which is the main product of the company.

Other voltage IGBT modules accounted for 24% of revenue. Other products account for a relatively small proportion, including MOSFET modules, rectifier and fast recovery diode modules, etc., accounting for 3% of the operating income. The IGBT module products of the company are rich and complete, covering industrial, automotive and household appliances applications. At present, the company has more than 600 kinds of IGBT products, with voltage level ranging from 100 V to 3,300 V and current level ranging from 10 A to 3,600 A.

CRRC Times Semiconductor is a subsidiary of CRRC Times Electric Co., Ltd., which mainly produces high-power thyristor, IGCT, IGBT and SiC devices and their components. With IDM mode, it focuses on rail transit, high-voltage power transmission and distribution and new energy market, and focuses on promoting supporting construction projects of new energy vehicle components, including system integration of electronic control, motor, IGBT and sensor. At present, the company's power device products should be applied to rail transit, new energy vehicles, photovoltaic inverters and other fields. IGBT has covered 750-6,500 V, and SiC devices have covered 650-1,700V V. 700-3,300 V hybrid SiC traction converters and 3,300 V all-SiC traction converters have been applied on a large scale.

Sanan Integrated is a subsidiary of Sanan Optoelectronics. Sanan Integrated Circuit covers compound semiconductor manufacturing platforms in the fields of microwave radio frequency, high-power power electronics, optical communication, etc. With IDM mode, it has substrate materials, epitaxial growth, and chip manufacturing capabilities. Since 2020, the company's sales and shipments have increased substantially, achieving a sales revenue of 375 million yuan, a year-on-year increase of 680.48%.

There are nearly 100 GaAs RF shipping customers, and the production capacity of important customers of GaN RF products is gradually climbing; There are more than 60 customers of electronic products, and 27 kinds of products have entered the stage of mass production. In addition to expanding the market leading share of the existing medium and low speed PD/MPD products, the optical communication business has 10G high-end products. APD/25G PD, VCSEL and DFB transmitter products have been verified by important customers in the industry, and have entered the stage of batch trial production; The product development performance of the filter is superior, and the production line is continuously expanding and being stocked.

At present, the company has completed the production platform of SIC MOSFET devices, and 1200V 80mΩ products have been developed and passed a series of product performance and reliability tests, which can be widely used in applications such as photovoltaic inverter, switching power supply, pulse power supply, high voltage DC/DC, new energy charging and motor driving.

Major foreign competitors

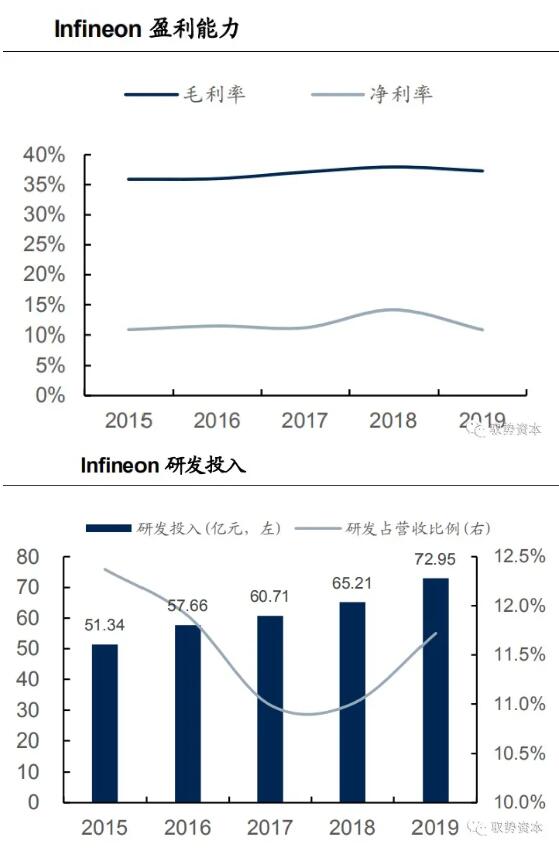

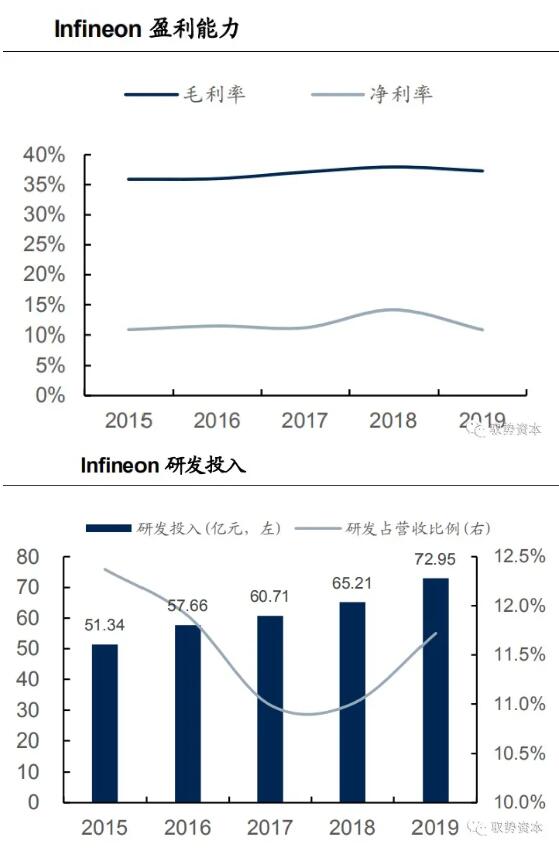

Yingling Technology Company was formally established in Munich, Germany in 1999, and is one of the world's leading semiconductor companies. Formerly known as the semiconductor division of Siemens Group, the company was independent in 1999 and listed in 2000. As the leader of international semiconductor industry innovation, the company provides advanced semiconductor products and complete system solutions for wired and wireless communications, automotive and industrial electronics, memory, computer security and chip card markets. As of December 18th, 2020, Infineon Technology Company has a market value of 40.5 billion USD, with a static valuation of 42 times.

As a leader in power semiconductors, Infineon is the only company in the market that provides a full range of power products covering silicon, silicon carbide and gallium nitride. It has a rich product portfolio such as the seventh generation CoolMOS™ with high cost performance, the high performance CoolSiC™ and CoolGaN™ based on the third generation wide bandgap semiconductors, and the sixth generation OptiMOS™ supporting higher frequency applications, so as to improve the power efficiency from the chip technology level. At the same time, Infineon is also the leader of IGBT technology. According to the latest data from IHS Markit, Infineon has a market share of 34.5% in the global IGBT market.

The company has been deeply involved in the field of automotive semiconductors for many years. In the past 20 years, the company's automotive semiconductor revenue has increased year by year, with a compound growth rate of about 10.1%. With the growth of new energy vehicle market in 2015, the revenue growth and market share of automotive semiconductors have expanded year by year. At present, the company has become the largest supplier of automotive semiconductors.

In the third quarter of 2020, the revenue of the automotive division was 1 billion euros, up by 29.08% from the previous month and 17.81% from the previous year. According to the company's third quarterly report, the substantial increase in revenue is mainly due to the increase in sales of electric vehicles and MCU. From the perspective of revenue composition, the company's power semiconductor revenue will be 55% in 2020, of which about half will come from the demand of new energy vehicles and autonomous driving.

Judging from the company's historical valuation, the company's PE multiple continued to rise in 2020, and the price-earnings ratio rose sharply after September 2020. The main reason was the outbreak of the European market of new energy vehicles in 2020. According to the statistics of the European Automobile Manufacturers Association (ACEA), the number of new energy vehicles registered in Europe increased significantly in 2020, and in the third quarter, it increased to about 270,000, up 221.6% year-on-year and 111.69% quarter-on-quarter.

According to Infineon's forecast for the future new energy vehicle market, the global new energy market penetration rate will exceed 23% in 2023 and 50% in 2027. In the future, the company will focus on the layout of the upgraded electric vehicle platform based on SiC power modules. At the same time, SiC MOSFET business will grow rapidly by virtue of a large number of customer advantages of IGBT. It is expected that the overall sales volume of automotive semiconductors will increase substantially.

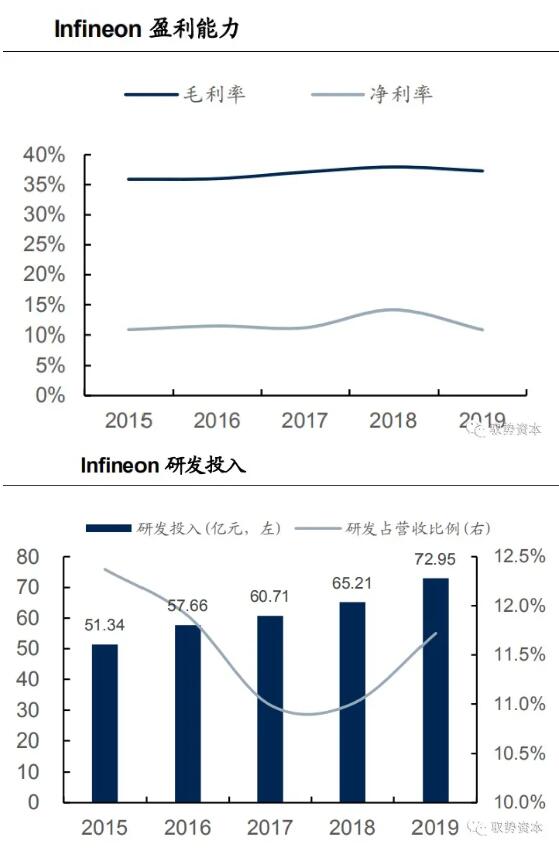

Mitsubishi electric Corporation, one of the core enterprises of Mitsubishi Group, was founded in 1921. According to the 2019 annual report of mitsubishi electric Co., Ltd., as of March 31, 2019, the number of employees of the company reached 145,817. Mitsubishi electric occupies an important position in the global market of power equipment, communication equipment, industrial automation, electronic components and household appliances. Mitsubishi electric's semiconductor products include power modules (IGBT, IPM, MOSFET, etc.), microwave/RF and high-frequency optical devices, optical modules and standard industrial TFTLCD, etc.

As the world's leading IGBT enterprise, mitsubishi electric is in a leading position in the field of medium-voltage and high-voltage IGBT. According to IHSMarkit 2018 report, the global market share in 2017 was 17.90%, second only to Infineon.As the world's leading IGBT enterprise, mitsubishi electric is in a leading position in the field of medium-voltage and high-voltage IGBT. According to IHSMarkit 2018 report, the global market share in 2017 was 17.90%, second only to Infineon.

Disclaimer: This article is reproduced from "EV Core News". This article only represents the author's personal views, and does not represent the views of Sacco Micro and the industry. It is only for reprinting and sharing to support the protection of intellectual property rights. Please indicate the original source and author when reprinting. If there is any infringement, please contact us to delete it.