Service hotline

+86 0755-83044319

release time:2023-09-15Author source:SlkorBrowse:8534

The global investment race

Global chip manufacturers are highly focused on the shift in size of SiC substrates. With Wolfspeed leading the way in launching 8-inch capacity, other suppliers are also actively following suit, seeking collaborations with key participants in the global supply chain to gain a favorable position in the market. With the announcements of significant investments, global wafer-level capacity is rapidly increasing.

Currently, 80% of SiC substrates worldwide are produced domestically in the United States, which positions the country as a leader in this critical technology and hopes to retain this position for as long as possible. "Based on our calculations so far, we estimate that the total investment in SiC wafer fabs globally is close to 14 billion dollars, and this is just the beginning," stated.

"With the new John Palmour Materials Factory located in North Carolina, Wolfspeed will increase its current SiC capacity by a factor of 10, with capital expenditure reaching 100% of revenue. These numbers are astonishing."

The shift in supply chain focus...

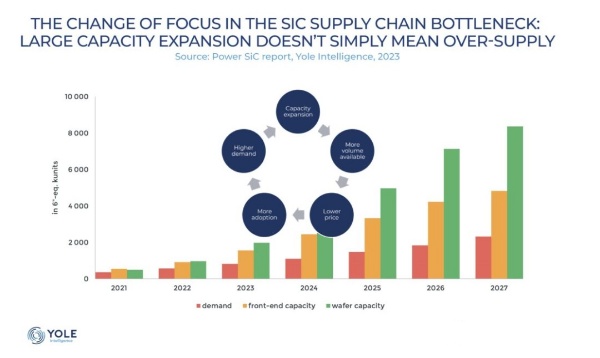

Yole Intelligence's latest research highlights a shift in focus regarding the bottleneck in the SiC supply chain. Expanding production capacity on a large scale does not simply translate to oversupply.

Poshun Chiu, Senior Technology and Market Analyst at Yole Intelligence, a division of Yole Group, points out that in 2022, there will be a trend of significant expansion in SiC wafers exceeding demand. Today's latest data tells a different story - the growing interest in using SiC devices has triggered the expansion of wafer and device production capacity.

As electric vehicles have been the main driving force in the SiC market, the shortage of SiC wafers in 2021 and 2022 limited opportunities for non-automotive applications to obtain SiC wafers. The expansion of SiC wafer capacity, set to be operational by 2023, will stimulate the growth of the SiC device market. The impact of cost optimization on SiC wafers used for MOSFETs and automotive applications will be relatively small. However, lower-quality players will need to lower prices to secure remaining utilization. We expect higher erosion of the prices of SiC diode-grade wafers. In the medium term, 8-inch wafers will primarily be reserved for internal use.

So, will silicon carbide be a sacrificial victim of its own success over time? "We can compare this to the case of blue LED sapphire," said Eloy. At that time, with the significant increase in production capacity by Chinese manufacturers in the mid-2010s, the price of sapphire dropped significantly. With competitive prices and accessible equipment, it accelerated the penetration of LEDs in the display and lighting industries. For SiC, the ecosystem will need to address the differences in demand/supply and quality."

"While we await the commissioning of new wafer fabs supported by the new CHIPS Act funding, ATREG expects more traditional 200mm manufacturing assets, as well as compound semiconductor-capable ones, to be converted into high-volume SiC manufacturing facilities in the coming months to bridge the short-term gap. The capacity required for the mid-term," summarized Rothrock. "I believe it is fair to say that silicon carbide still has a bright outlook in the foreseeable future."

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd