Service hotline

+86 0755-83044319

release time:2023-09-05Author source:SlkorBrowse:7024

Introduction:

Driven by the increasing demand in the automotive terminal market and the price parity with silicon, the production of silicon carbide (SiC) is growing rapidly.

Thousands of power semiconductor modules have already been used in electric vehicles for on-board charging, traction inverters, and DC-to-DC conversion. Most of them are currently manufactured using silicon-based IGBTs. However, the shift to SiC-based MOSFETs has doubled power density and accelerated switching speed in smaller, lighter packages.

The requirements for high voltage and operation in hot and harsh environments are becoming increasingly demanding for electric vehicles and charging stations. However, due to the higher manufacturing and packaging costs of wide bandgap materials, it will take some time for silicon carbide (SiC) to gain a solid footing. Nevertheless, this situation is changing. Victor Veliadis, Executive Director and Chief Technology Officer of PowerAmerica, stated that the prices of SiC power modules are now comparable to silicon-based modules, which in turn promotes supply partnerships and the construction of new SiC factories.

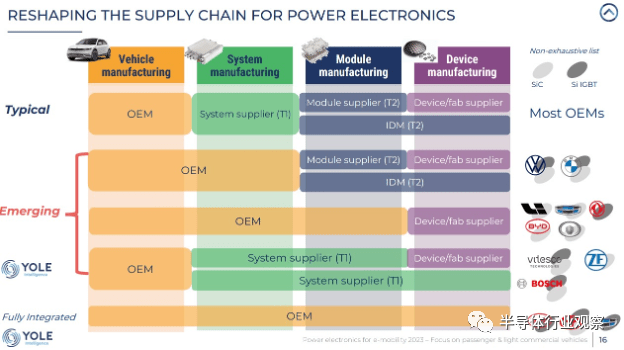

There is still much work to be done. SiC wafer technology needs to be upgraded. Manufacturing these devices requires 20% new process tools and 80% improved tools. Our goal is to accelerate the turnover speed of integrated and discrete power devices, which is why automotive manufacturers are turning to direct wafer-to-module collaboration with foundries.

New wafer fabrication tools include high-temperature epitaxial growth (>1,500°C), thermal ion implantation, rapid thermal processing (RTP), and faster pulse atomic layer deposition. Significant improvements are being made in wafer grinding, chemical mechanical polishing (CMP), polishing pads, and slurries for the hard and brittle SiC material. New materials, including release agents and cleaning chemicals, meet equipment and sustainability requirements.

From the packaging perspective, high-power printed circuit boards with discrete components are being replaced by integrated packaging such as integrated circuits and chip-scale packaging (CSP) to achieve smaller and more reliable high-voltage operations. This allows electric vehicles to be equipped with smaller and lighter battery packs, which helps increase their driving range. While the focus today is on SiC power and expanding Si power modules into hybrid and electric vehicles, future SiC modules will dominate in electric vehicles. Additionally, GaN will find niche markets in electric vehicles, grid power, and smart energy sectors.

By 2030, the world will produce 39 million pure electric vehicles, which is equivalent to a compound annual growth rate of 22% from 2022 to 2030. This in turn drives the power semiconductor market, with approximately 50% of silicon devices, 35% of silicon carbide devices, and 12% of gallium nitride devices expected to be used in the market until 2030. In electric vehicles, traction inverters convert DC power from the battery pack into AC power to provide power to drive the front and rear motors. SiC can also accelerate the charging of on-board and off-board systems and bring power from the grid to electric vehicles.

Most importantly, SiC modules form the cornerstone of the transition from 400V batteries to 800V batteries. When charging speeds are faster, driving ranges are sufficient, and the cost of the battery pack per vehicle is below $10,000, consumers will adopt electric vehicles more quickly.

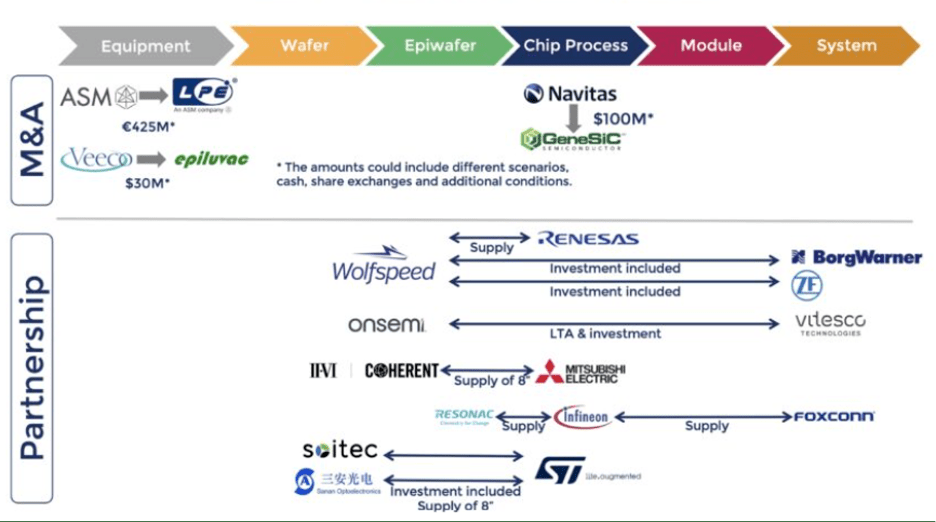

SiC modules are reaching a critical point where they are cost-competitive with silicon-based power solutions while achieving higher efficiency and more compact systems. Coupled with the expansion of the 800V battery range from the currently used 400V batteries (containing 600V or 650V devices), mass production of 1,200V SiC devices is being stimulated. However, supply chain changes such as the impact of wafer crystal defects on yield, losses in device packaging and module integration, and closer connections between car manufacturers and power system manufacturers are still ongoing. From a practical perspective, it will take some time for new SiC wafer and wafer fab capacity to reach mass production.

However, this has not dampened people's enthusiasm for the technology. Analysts continue to raise their SiC market forecasts. Yole Group predicts that the power semiconductor market will reach $6.3 billion by 2027, with 70% for automotive applications. Looking only at SiC wafer production (starting from SiC wafers), TECHCET predicts a compound annual growth rate of 14% from 2022 to 2027.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd