Service hotline

+86 0755-83044319

release time:2023-09-15Author source:SlkorBrowse:8967

The remarkable rise of the global silicon carbide (SiC) market has undoubtedly attracted attention. As early as 2017, the transition from silicon to SiC in power semiconductor applications began with the installation of SiC in Tesla's Model 3. In 2019, chip manufacturer Wolfspeed chose the Nanocenter facility near Utica, New York, to build the world's first 200mm SiC factory in the United States. The factory was completed in April 2022.

Since then, the SiC gold rush in the United States has transformed into a global investment frenzy, primarily driven by the increasing demand for electric vehicles. While silicon carbide is clearly a key technology for the future of semiconductors, as it enters the mainstream power electronics market, does it face the risk of quickly becoming commoditized?

In this article, Stephen Rothrock, the founder and CEO of ATREG, Jean-Christophe Eloy, President, and founder of Yole Group, and Poshun Chiu, Senior Technology and Market Analyst at Yole Intelligence, outline the global SiC market and their predictions for the future of this revolutionary technology.

Record-breaking market growth

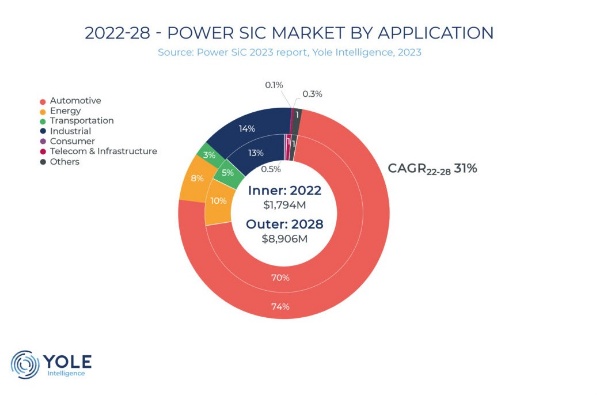

According to the latest edition of the Power SiC report released by Yole Intelligence, it is projected that the global power SiC device market will grow to nearly $9 billion by 2028, representing a 31% increase compared to 2022. Automotive applications dominate the SiC market, accounting for 70% of the market share. By 2022, the power SiC market is expected to expand further into various industrial applications including transportation, energy, and telecommunications.

Stephen Rothrock stated that in the 25 years that ATREG has been tracking the global semiconductor manufacturing asset market, they have never seen a new technology develop as rapidly as SiC. Despite the current downturn in the industry, strong growth in SiC is being witnessed. With the help of SiC power devices, major IDM manufacturers worldwide see opportunities for growth.

According to Yole Intelligence, STMicroelectronics has maintained a leading position in SiC device revenue in recent years. The company had approximately $700 million in revenue in 2022, and it is projected to reach $1.2 billion in revenue in 2023. Following behind the global power electronics leader Infineon Technologies, the company has shown significant revenue growth in the past two years.

"Wolfspeed, Onsemi, ROHM, and Bosch are considered top players in achieving revenue growth," added Jean-Christophe Eloy. "Leading companies have implemented the IDM business model to expedite the time to market for this rapidly growing and profitable SiC device business."

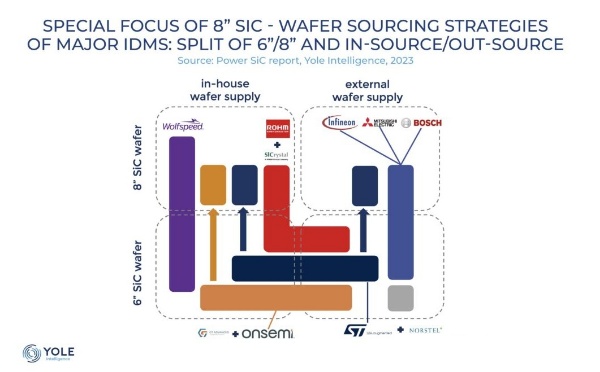

Yole Intelligence's research also indicates that 150mm SiC wafers are currently the main platform for device manufacturing, with no bulk shipments of 8-inch wafers on the public market yet. For the existing or planned construction of 200mm SiC wafer fabs, major IDMs are adopting different procurement strategies based on their positions within the semiconductor ecosystem. Wolfspeed is currently the only company dedicated to increasing its 200mm SiC production capacity at its Mohawk Valley facility in New York. Other manufacturers are expanding their internal 150mm wafer capacity while simultaneously developing 200mm wafers.

"For companies that do not intend to transition to 8-inch wafers, the most common approach is to procure 150mm SiC wafers multiple times," pointed out Chiu. "In 2021, Onsemi acquired SiC wafer company GT Advanced Technologies (GTAT), while ROHM acquired SiCrystal in 2009. However, we understand that these companies are also procuring a large number of 150mm SiC wafers from external wafer suppliers." he added.

In 2019, STMicroelectronics acquired Norstel, a SiC wafer company, to develop internal wafer capacity. At the same time, the company collaborated with Soitec to develop engineered substrates, and partnered with Sanan Optoelectronics to form a joint venture worth $3.2 billion to supply 8-inch SiC wafers. Infineon Technologies and Mitsubishi Electric focused on device processing on the 200mm SiC platform and used external suppliers for 200mm wafers.

On August 31st, Bosch announced the completion of its acquisition of TSI Semiconductors' 200mm wafer fab in Roseville, California, facilitated by ATREG. After a restructuring phase starting in 2026, the facility will begin producing the first batch of SiC chips on 200mm wafers. Attracting one of Europe's largest manufacturers to the United States (which previously only produced front-end chips in Germany) is a significant victory for the U.S. semiconductor industry, as Bosch plans to invest $1.5 billion in the Roseville facility over the next few years.

Despite being relatively late in the power SiC device market, Onsemi's performance in the first quarter of 2023 suggests the company is poised to achieve ambitious revenues of $1 billion in 2023. As the preferred SiC device supplier for Tesla and other automotive original equipment manufacturers, the company's revenue is largely driven by deep involvement in electric vehicle shipments. As part of a $1 billion investment announced in 2021 for the next decade in the SiC field, Coherent has accelerated its SiC substrate and epitaxy manufacturing expansion plans in Sweden and the United States. The wafer production capacity of its Easton, Pennsylvania facility is expected to reach 1 million wafers by 2027, equivalent to 150mm substrates, with 200mm already in mass production.

In Europe, Wolfspeed is collaborating with ZF to build an advanced 200mm SiC plant in Germany's Endorf, with a $3 billion investment to support the massive transformation of the German automotive industry. Continental has signed a multi-year supply agreement for silicon carbide devices with STMicroelectronics, while STMicroelectronics has received €292.5 million in funding from the European Commission for the construction of a wafer fab in Catania, Sicily.

In Asia, Infineon recently announced plans to build the world's largest 200mm SiC power plant in Kulim, Malaysia, with a potential revenue of €7 billion by the end of this decade. Additionally, Renesas Electronics has partnered with Wolfspeed to execute a wafer supply agreement, paying a $2 billion deposit to secure a 10-year commitment from Wolfspeed for SiC wafers and epitaxial substrates.

To be continued...

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd