Service hotline

+86 0755-83044319

release time:2025-03-13Author source:SlkorBrowse:16546

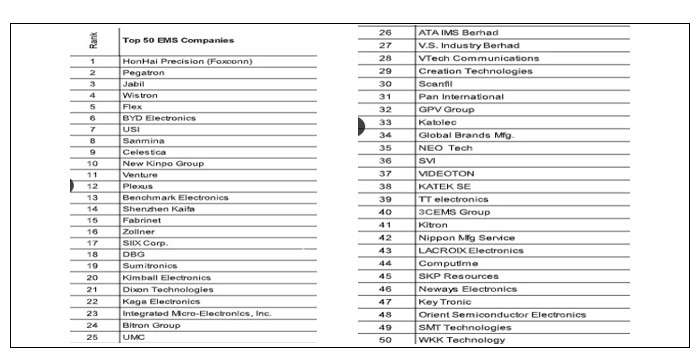

Nevada, California - Manufacturing Market Insider, a news publication focused on the Electronics Manufacturing Services (EMS) industry, has released its annual MMI Top 50™ Global EMS Providers list. In 2023, the Top 50 recorded sales of $423 billion, a decrease of $26 billion.

The rankings are calculated based on an annual survey of over 100 major EMS companies worldwide. The results indicate that only Tier 1 companies, namely Hon Hai Precision Industry Co. (Foxconn) and Pegatron, had a tough year, while Tier 2 and 3 companies performed well in many cases, showing remarkable growth. With the release of the MMI Top 50™ survey results, it can be said that 2023 was not a good growth year overall, with a negative growth rate of -5.8%, although there were still more positive results than negative ones.

The growth rate of the Top 50 represents the revenue of other companies in the industry as a whole, as a few companies experienced declines in revenue. The Top 50 usually accounts for 85-90% of the total industry revenue, so this percentage may change in our annual report, which will be published in June, depending on the situation of the remaining 15% of companies. In recent years, the expansion of the Top 50 has been driven by EMS giant Hon Hai Precision Industry Co. (Foxconn) due to its scale and strong growth rate. This year, Foxconn's revenue declined by 11.6%, causing the overall industry growth rate to drop, while Pegatron declined by 13.6%.

Industry participants cannot expect these industry giants to continue expanding at a double-digit pace, as sustaining such large numbers is challenging compared to Tier 2-4 suppliers, which have experienced rapid growth in recent years due to acquisitions. As an example, GPV achieved the highest growth rate of 81.2% in 2023 and 65.1% in 2022.

Overall, the APAC region accounted for approximately 74.7% of the Top 50 EMS revenue, while the Americas accounted for 22.8%, an increase of 2.4%, and the EMEA region accounted for 2.5%, an increase of 0.3%, mainly due to significant acquisition activity. To enter the Top 50, a minimum sales revenue of $43.4 million is required, a decrease of $14 million from the previous year.

In 2023, the top 10 companies accounted for 88.7% of the Top 50 sales revenue, slightly lower than 89.1% in 2022, indicating that the EMS industry still heavily relies on the top players. The remaining 40 companies collectively achieved a growth rate of 12.6%, increasing from $44.5 billion in 2022 to $50.1 billion reported in 2023.

In addition to provider rankings based on 2019 sales revenue, the MMI Top 50 list also includes sales growth rates, previous rankings, employee counts, number of facilities, facility space, space in low-cost regions, SMT line counts, and customer data. These specialized data have been featured in the MMI special issue in March 2024, and the April newsletter will include market segment data obtained from the MMI survey. Please contact the publisher to purchase the individual report. Manufacturing Market Insider, established in 1990, is a monthly newsletter providing professional coverage of the EMS industry and is a division of New Venture Research Corp.

Hon Hai Precision Industry (Foxconn)

With a revenue of $214.5 billion and nearly 40% market share, Foxconn continues to maintain its leading position in EMS, surpassing the second-place Pegatron by more than four times. As the world's largest electronics contract manufacturer, Foxconn is primarily involved in the R&D and manufacturing of computer, communication, and consumer electronics products.

Pegatron

Established in 2008 following a split from Asus, Pegatron operates iPhone assembly factories in Shanghai, Suzhou, and Kunshan. Over 50% of the company's profits come from Apple's contract manufacturing.

Wistron

Wistron is one of the world's largest ODM contract manufacturers, specializing in information and communication technology products, including laptops, desktop systems, servers, storage devices, networking, and communication products. It offers comprehensive support for ICT product design, production, and services, with most clients being globally renowned high-tech companies.

Jabil

In 2006, Jabil acquired [敏感词] Green Point for NT$30 billion and later acquired precision plastics manufacturer Nypro for $665 million. Currently, Jabil operates over 100 factories in more than 20 countries, providing services such as design, development, production, assembly, system technical support, and end-user distribution in computer peripherals, data transmission, automation, and consumer products.

Flex

Flex is one of the largest EMS manufacturers globally, having acquired U.S.-based EMS manufacturer Solectron in 2007. Established in Singapore in 1981, it became the first U.S. company to establish overseas manufacturing facilities. The company operates across 29 countries on four continents, offering services including mobile circuit board design, communication engineering, automotive parts manufacturing, and logistics.

Luxshare Precision

Luxshare mainly produces and operates components, modules, and system products such as connectors, acoustics, wireless charging, motors, antennas, smart wearables, and smart accessories. Its products are widely used in computers and peripherals, consumer electronics, communications, automotive, and medical fields.

BYD Electronic

BYD Electronic provides a one-stop service for customers, including product R&D, innovative materials, precision molds, components, EMS and ODM, supply chain management, logistics, and after-sales services. Its business covers smartphones, computers, new smart products, automotive intelligent systems, and medical health fields.

Hansol Technics

A subsidiary of the Amkor Group, Hansol Technics is a holding company with a diverse range of electronic products, including communication, computer and storage, consumer electronics, industrial products, and primarily automotive electronics.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd